25+ Investment property loans

Minimum down payment of 25 for 24-unit properties. 75 on a 3 to 4 unit owner-occupied 1 to 4 unit investment property.

Investment Property Loans Mint Mortgage Dba Of Point Mortgage Corporation

Minimum down payment of 15 for 1-unit properties.

. However theres typically fairly high down payment requirements of at least 15-25 for investment properties and your personal credit history and score factor into your. We offer loans for. Shared Equity May Be The Best Solution.

However the rules are a little stricter for an investment property loan than for a mortgage on your primary home. Apply Today Save Money. It can be a hedge against.

The Complete Guide To Financing An Investment Property. Here are the requirements for investment property loan eligibility. Paying off a 1st andor 2nd mortgage closing costs andor getting cash back for another purpose.

Ad Get a Business Loan From The Top 7 Online Lenders. Investment Loans allow you to buy a one-to-four unit residential. Grow Your Business Now.

For example Denver County FHA Loan Limits in 2022. Tap Home Equity Without Monthly Payments. You can put down as little as 35 if you purchase with FHA as long as you occupy one of the units.

Compare Now Find The Lowest Rate. However FHA loans allow down payments as low as 35 for a single-family home used as a. The loans range between 20 and 25 years.

Your credit score should be at or. Ad Compare the Best Investment Property Mortgages From Top Companies Apply Easily Online. Can you buy an investment property with less than 25 down.

The home can have more than one unit with up to four units. Get Instantly Matched With Your Ideal Lender. The speedy and easy internet financing.

Most fixed-rate mortgages require at least a 15 down payment with a 680 qualifying credit score for a one-unit investment property. Take Advantage Of 2022 Mortgage Rates When You Buy Your Next Home. Compare loan options interest rates closing times and more from the top investment property lenders.

Lendio potentially helps provide funds in less than 45 days which can prove beneficial if you are constrained to a tight timeline. Real Estate Investing Guide. 1 talking about this.

There are many reasons and ways to invest in real estate. Investment Property Loan Requirements. Ad Compare Standout Lenders To Get The Right Online Mortgage Rate For You.

Best Investment Property Lenders of 2022. Ad View Compare Current Investment Property Loan Rates. Ad Need A Down Payment For An Investment Property.

Ad Compare the Best Investment Property Mortgages From Top Companies Apply Easily Online. Investment Property Loan PRO-TIP. Minimum credit score of 620.

Investment property loans are mortgages used to finance the purchase of a property that will be used for investment purposes. Here at BTE Financial we strive to always be your main resource with regard to personal loans in Fawn Creek KS no matter your credit rating. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

For instance you likely need 15-20 down instead of 3-5. As a rule of thumb investors use a down payment of 25 to finance an investment property. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Your credit score should be at or. Conventional mortgages generally require at least 15 down on a one-unit investment property and 25 down on a two- to four-unit investment property. The property cannot be owner-occupied.

Ad Buying Investment Property Is Surprisingly Simple With Our Guaranteed On-Time Closing. Ad Compare Loan Options Calculate Payments Get Quotes - All Online. No-tax-return investment property lenders generally want to see DSCR above 100 and sometimes offer better pricing if the DSCR is above 125-150.

According to the Fannie Mae eligibility matrix you will require a credit score of 700 or higher for any down payment less than. Investment property is a piece of land or a building that is bought with the intention of producing a financial return as opposed to personal use or occupation by the. Youll Close In As Soon As Three Weeks Or Well Give You 5000.

Dont Settle For Just One Offer - Compare Rates And Find Best Options. Most fixed-rate mortgages require at least a 15 down payment with a 680 qualifying credit score for a one-unit investment property. Whether you need funding for an investment property or your business we have you covered.

Ad Quickly get matched with top Commercial lenders across the country based on your needs.

Bios Home Headquarters

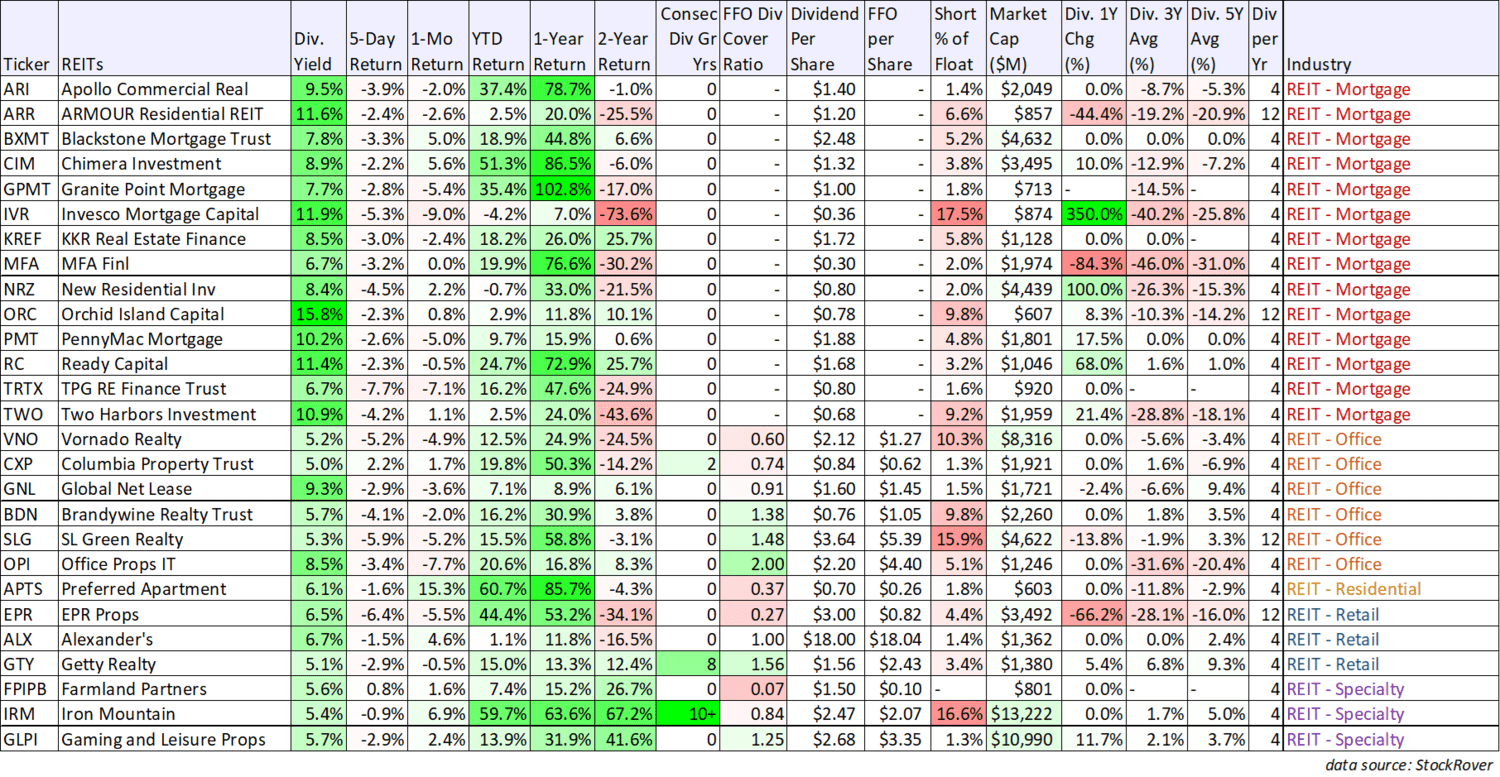

75 Big Dividend Reits Bdcs Cefs These 3 Are Worth Considering Seeking Alpha

A Quick Guide To Investment Property Loans And Mortgages Azibo

Hard Money Loan Complete Guide On Hard Money Loan With Example

1st Florida Lending I No Doc Hard Money Loans

A Guide To Rental Property Loans Global Integrity Finance

/preapproved_mortgage_FINAL-22c6cd19ccd34815a10baa195848112d.png)

5 Things You Need To Be Pre Approved For A Mortgage

Asset Based Loans For Beginners Think Realty A Real Estate Of Mind

Why Would Anyone Buy A 5 Unit Rental Property Having To Pay 25 Down When They Can Just Buy A 4 Unit And Pay 5 Down Quora

Tap Into Private Lending When Buying A Short Term Rental Think Realty A Real Estate Of Mind

Hard Money Loan Complete Guide On Hard Money Loan With Example

Why Would Anyone Buy A 5 Unit Rental Property Having To Pay 25 Down When They Can Just Buy A 4 Unit And Pay 5 Down Quora

Dividend Kings List And Definition

Long Term Rental Loans Think Realty A Real Estate Of Mind

75 Big Dividend Reits Bdcs Cefs These 3 Are Worth Considering Seeking Alpha

Aodwalqrnbi5hm

How I Earn Over 10 Passive Income With P2p Lending